Private Mortgage Lending Made Simple

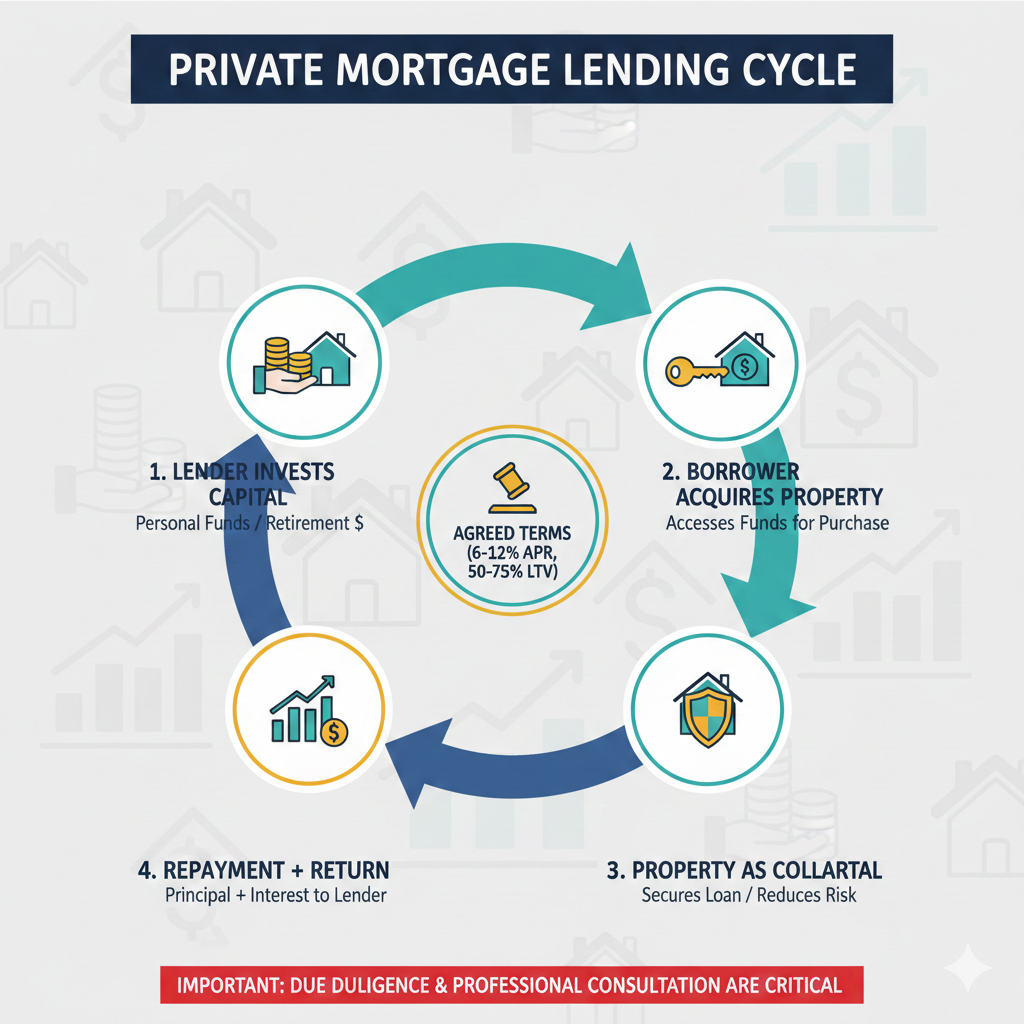

Private mortgage lending is when an individual lends their own money—such as cash or retirement funds—to someone else in exchange for an agreed interest rate. These loans are usually backed by real estate, which helps protect the lender. Like any investment, careful planning and research are key to managing risk.

Benefits for Investors and Borrowers

Private mortgages can benefit both sides. Investors often earn higher interest rates than traditional bank accounts or loans, while borrowers can access funds more quickly and with fewer complications than conventional financing.

How Private Lenders Should Approach It

Private lenders should act like a mortgage company, screening borrowers and properties carefully. Doing thorough research and due diligence helps reduce risk and ensures a safer investment.

Loan Terms and Structures

Private mortgage loans can be short-term (6 months to 2 years) or long-term (2 to 10+ years). Loan-to-value (LTV) ratios usually fall between 50% and 75%, and interest rates often range from 6% to 12%, depending on the property and market. Lower LTVs reduce risk by providing an equity cushion if the borrower defaults.

Loan structures can be flexible. Many use simple interest with interest-only payments, but some agreements may include amortized payments, deferred payments, or equity-share arrangements. In equity-share deals, lenders may receive a portion of the property’s profit when it is sold, in addition to interest.

Building Equity and Exit Strategies

Borrowers may build equity over time, especially with fully amortized loans. Some may later refinance through conventional lenders at a lower interest rate.

Important Disclaimer

Private mortgage lending carries risks. Investors should carefully research both the borrower and the property before investing. Consulting legal, financial, and tax professionals is strongly recommended to ensure compliance and alignment with personal investment goals.

For more information and to see if private mortgage lending fits your investment strategy, contact us today.